The surprise problem nobody plans for

You sell some stocks. Or a rental property. Or maybe a chunk of a long-held ETF. The trade goes great. You lock in profits. Life is good.

Then Medicare shows up two years later and says:

“Congrats on your gains. Your premiums just went up.”

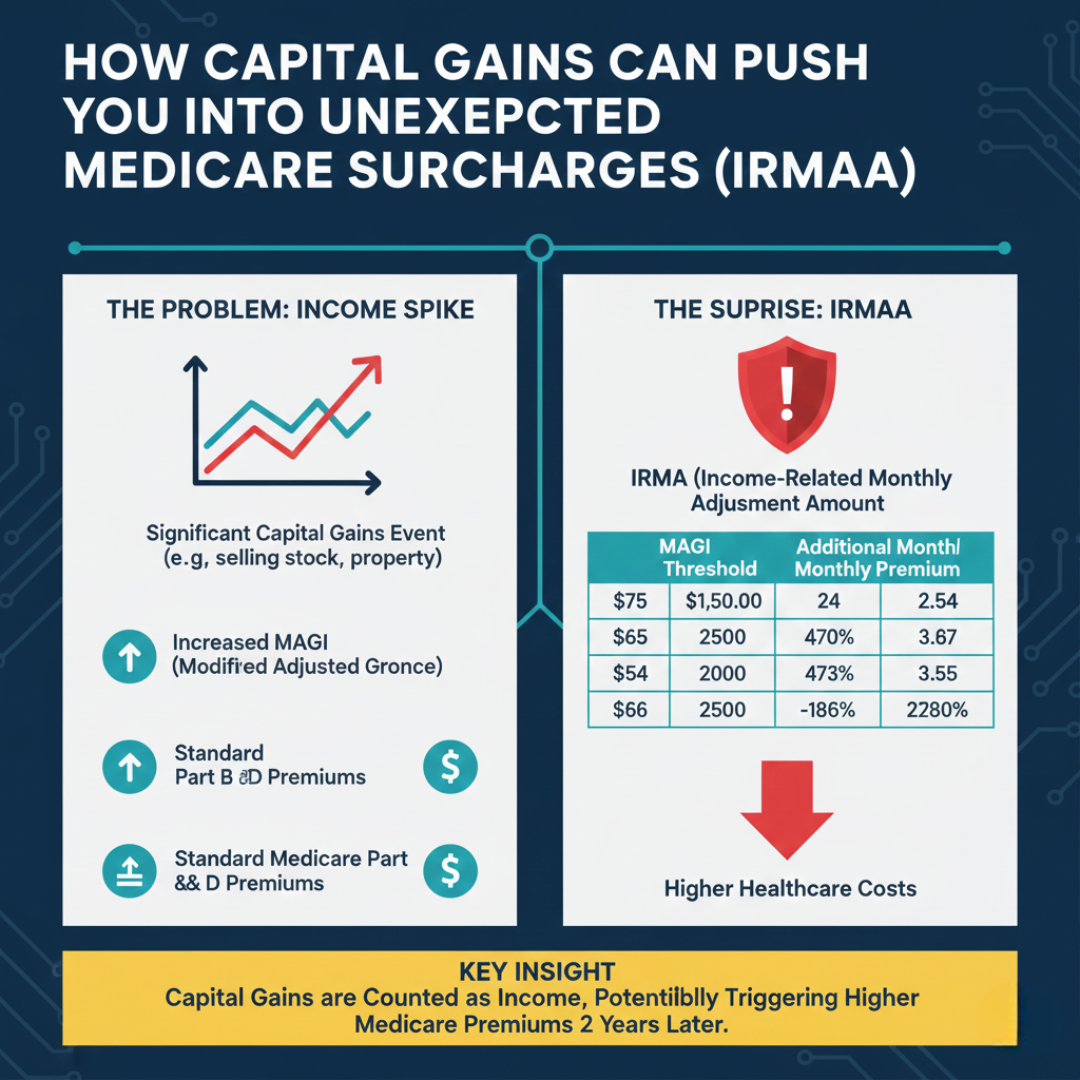

This is IRMAA — the Income-Related Monthly Adjustment Amount. It’s a surcharge added to Medicare Part B and Part D premiums when your income crosses certain thresholds.

And capital gains count as income for this purpose.

Not “kind of.”

Not “maybe.”

Fully. Completely. Ruthlessly.

What IRMAA Actually Is (Plain English)

IRMAA is Medicare’s way of charging higher-income retirees more for healthcare.

Medicare looks at your Modified Adjusted Gross Income (MAGI) from two years ago and decides whether you owe extra each month.

MAGI includes:

- Wages

- Pensions

- Social Security (partially)

- Interest and dividends

- Capital gains (short-term and long-term)

Sell one big asset in a single year, and Medicare treats you like you permanently leveled up in income — even if it was a one-time thing.

Why Capital Gains Are the Silent Trigger

Here’s why this catches people off guard:

Capital gains feel different from “income.”

They’re not a paycheck.

They might be a once-in-a-decade sale.

But IRMAA doesn’t care about feelings. It only cares about the number on your tax return.

A single large gain can:

- Push you over an IRMAA income threshold

- Trigger hundreds or thousands per year in extra premiums

- Affect both spouses if you’re married

And because IRMAA is assessed monthly, the cost sneaks up slowly — death by a thousand premium cuts.

How the IRMAA Thresholds Work (Conceptually)

Medicare uses income brackets, similar to tax brackets.

Cross a threshold by even $1, and:

- You pay a higher Part B premium

- You pay a higher Part D premium

- The increase applies for the entire year

These thresholds are adjusted periodically, but the structure stays the same:

- Standard premium up to a certain income

- Tiered surcharges as income rises

- Multiple brackets, each more painful than the last

This is why income timing matters more than people realize.

A Simple Example (The “Oops” Scenario)

Imagine this situation:

You’re retired.

Your normal annual income sits comfortably below an IRMAA threshold.

Then you sell $120,000 worth of stock with a $90,000 long-term gain.

On paper:

- Great investing

- Reasonable tax bill

- No problem, right?

But your MAGI spikes for that year.

Two years later:

- Medicare re-evaluates

- Your Part B premium jumps

- Your Part D premium jumps

- Your spouse’s premiums jump too

The kicker?

That extra Medicare cost has nothing to do with whether you reinvested or spent the money.

The IRS saw income. Medicare followed.

Why This Hurts More in Retirement

During working years, IRMAA often gets lost in the noise of high income.

In retirement:

- Income is usually carefully controlled

- Budgets are tighter

- Healthcare costs matter more

- One unexpected increase ripples through everything

IRMAA breaks the illusion that “lower taxable income = lower expenses” automatically.

How to Reduce or Avoid IRMAA From Capital Gains

This is where strategy matters.

1. Spread Gains Across Multiple Years

Instead of selling everything at once, consider:

- Selling portions over several tax years

- Keeping MAGI below IRMAA thresholds each year

This alone can save thousands.

2. Offset Gains With Capital Losses

Capital losses from other investments can:

- Reduce your net capital gains

- Lower MAGI

- Keep you under an IRMAA bracket

Loss harvesting isn’t just for taxes — it’s healthcare planning.

3. Use Tax-Advantaged Accounts Strategically

Selling assets inside:

- Roth IRAs

- Health Savings Accounts (HSAs)

does not create taxable capital gains and does not increase MAGI.

This is why Roth conversions and asset placement matter long before retirement.

4. Time Large Sales Around Life Events

Certain life-changing events allow you to appeal IRMAA:

- Retirement

- Death of a spouse

- Divorce

- Loss of pension income

If your income dropped after the high-gain year, you may be able to request a reduction using Medicare’s appeal process.

Not automatic. But possible.

The Big Mental Shift to Make

Capital gains are not just about:

- Tax brackets

- Long-term vs short-term rates

- Federal vs state tax

They also affect:

- Medicare premiums

- Social Security taxation

- Healthcare affordability

In other words: capital gains stack.

They stack on your taxes.

They stack on your benefits.

They stack on your monthly costs.

Final Thoughts: Plan Before You Sell, Not After

IRMAA is one of those rules that feels unfair — until you realize it’s completely predictable.

The math is public.

The thresholds are known.

The surprise only happens when planning doesn’t.

Before selling a major investment in retirement, it’s worth running the numbers — not just for taxes, but for healthcare premiums too.

Because paying extra tax once hurts.

Paying extra Medicare premiums every month for a year or more hurts quietly… and repeatedly.

And quiet costs are the most dangerous ones of all.

Before making any major investment sale, it helps to see the numbers clearly — including how capital gains might affect your taxes and Medicare premiums. To get a quick estimate, you can use our Capital Gains Tax Calculator at CapitalTaxGain.com. It lets you plug in your sale price, cost basis, and holding period so you can forecast potential taxes before you sell, not after the surprise arrives.

Leave a Reply