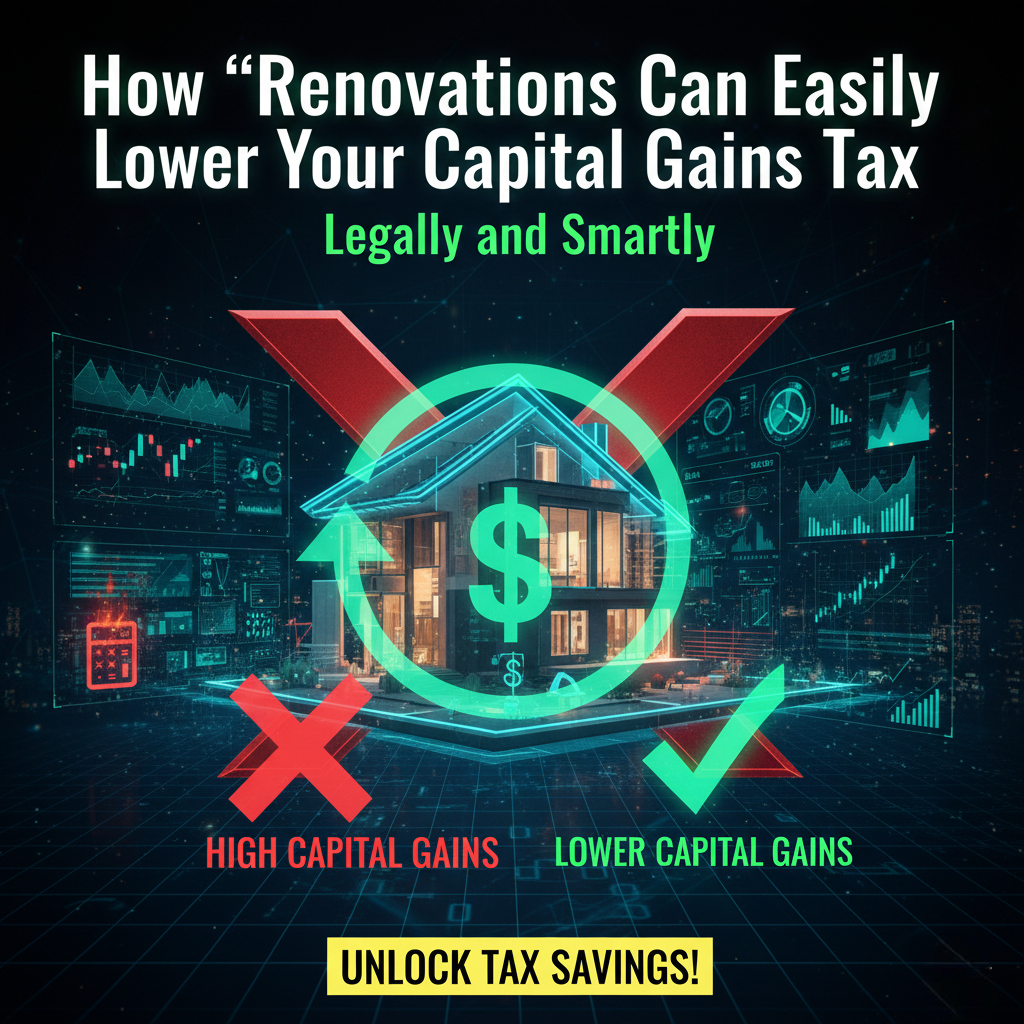

Every year, Americans legally hand over billions of extra dollars in capital gains tax that they didn’t actually need to pay.

Not because they cheated.

Not because they were reckless.

But because they didn’t know how the rules quietly work together and made Tax Mistakes.

Capital gains tax is one of those systems that looks simple from far away and turns into a maze the moment real life enters the picture. A stock sale here. A home sale there. A retirement account withdrawal layered on top. Add timing, benefits, and income thresholds, and suddenly a “good financial decision” comes with a painful aftertaste.